Energy companies know too well that they should adopt a medium to long term perspective when it comes to achieving sustainable growth, especially during times of significant volatility like the ones we have been experiencing the last few years. Despite the severe fluctuations in the prices of oil and gas, investment in R&D, people and technology need to continue. Complying with often complex regulatory requirements, cost containment and control improvement are only a few of the challenges faced.

- Cyprus and East Med hydrocarbon potential

- Oil and gas regulatory framework

- Energy regulatory authorities

- Offshore Licensing Rounds and key developments in the Cyprus Oil & Gas Industry

- Oil & Gas Tax Regime

- Utilities

- Mining

Cyprus and East Med hydrocarbon potential

Cyprus has attracted increasing prominence as an international financial centre since its 2004 full accession into the EU. An increasing number of large multinational corporations (MNC's), including leading Oil & Gas Groups, have been structured through the island taking advantage of its OECD fully compliant taxation system, higly educated workforce and open economy.

The island not only lies at the crossroads of important international trade and energy routes but in all probability is surrounded by substantial oil and gas resources, a significant part of which falls within the Cyprus Exclusive Economic Zone (EEZ). Assessments by USGS bring the level of undiscovered oil and gas resources in the Eastern Mediterranean to a total of 3.4 bbl for oil and circa 345 tcf for natural gas.

In terms of major findings to date in the Eastern Mediterranean, Israel has already announced significant findings at Leviathan and Tamar totaling 32tcf of natural gas and still unproven quantities of oil whereas Egypt’s supergiant discovery, Zohr, discovered in August 2015, in the order of 30 tcf has come to confirm and further boost the resource potential in the region. Cyprus to date has announced a 4.5 tcf natural gas discovery (Aphrodite), which is very significant if one takes into account the island’s needs in natural gas which do not exceed 0.035 tcf/year (1bcm/year).

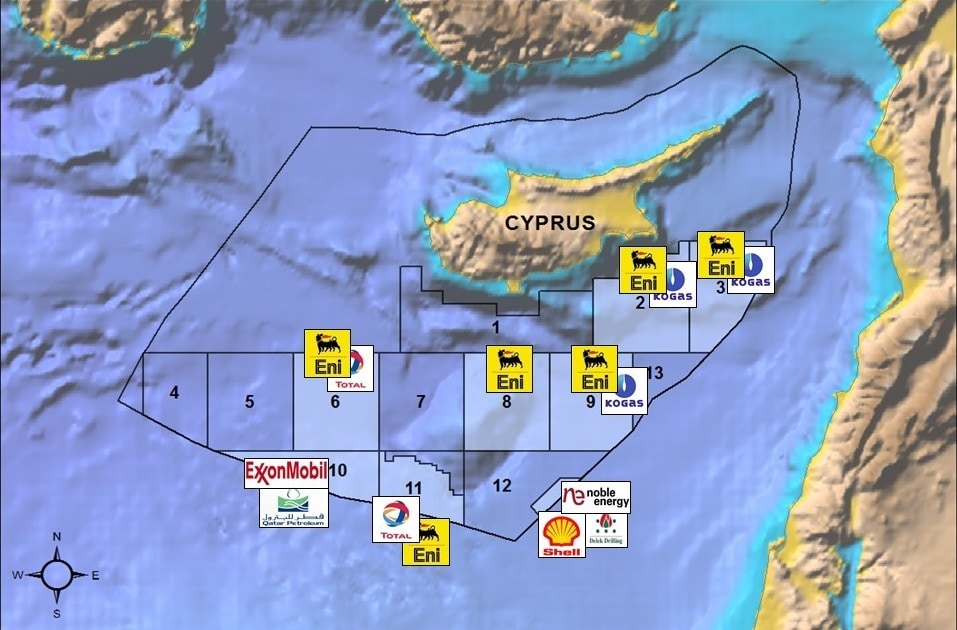

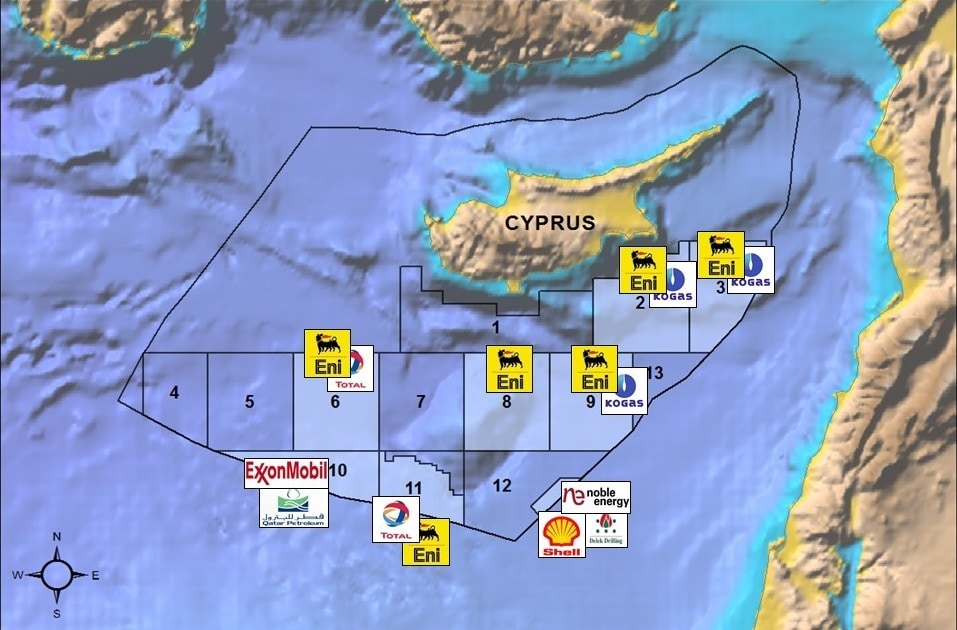

To date, 13 exploration blocks have been deliminated by the Republic of Cyprus at the south of the island following international bilateral agreements with Egypt, Lebanon and Israel on the basis of the UN Convention of the Law of the Sea (UNCLOS) 82. Substantial geological and geophysical data has been gathered the last few years for a number of these blocks and are available in the form of Multi Client Seismic Surveys and Interpretation Reports.

Oil and gas regulatory framework

The Government of Cyprus through the Energy Service of the Ministry of Commerce, Industry and Tourism and other government agencies has put together a number of Laws and Regulations since 2004, governing hydrocarbon exploration and exploitation in Cyprus.

Based on UNCLOS 82 Cyprus has enacted a law in order to define and regulate its EEZ. In 2004 Cyprus passed the Exclusive Economic Zone Law, 2004 (L.64(I) of 2004) – ‘EEZ Law’. Based on the provisions of the ‘EEZ Law’, Cyprus has signed the delimitation agreements with its neighbors (Israel, Lebanon and Egypt) in order to define its EEZ.

The main EU legal instrument by which oil and gas activities in Cyprus are governed by is the Directive 94/22/EC of May 1994 according to which EU member states have sovereign rights over the hydrocarbon resources within their territories.

The above directive is transposed into domestic law by:

The Hydrocarbons (Prospecting, Exploration and Exploitation) Law of No.4(I)/2007 which in 2015 has been amended by Law 186 (I)/2015 (Hydrocarbons Law) .

The Hydrocarbons (Prospecting, Exploration and Exploitation) Regulations of 2007 and 2009 (No.51/2007 and No.113/2009) which in 2014 have been amended by Hydrocarbons (Prospection, Exploration, and Exploitation) Regulations of 2007 to 2014

Offshore Licensing Rounds and key developments in the Cyprus Oil & Gas Industry

- 2006-2008: Seismic surveys within Cyprus’s EEZ.

2007: 1st Oil & Gas Licensing Round Offshore Cyprus (For more information click here)

2008: Exploration License awarded for Block 12 to Noble Energy International Limited.

2011: Noble Energy drilled its first exploratory well and at the end of the year the first natural gas discovery was announced.

2012: 2nd Oil & Gas Licensing Round Offshore Cyprus (For more information click here)

2013: 30% of Noble’s Energy exploration rights in Block 12 are transferred to the Israeli companies Delek Drilling and Avner Oil Exploration.

The Republic of Cyprus awards exploration licenses for Blocks 2,3 and 9 to the consortium ENI-KOGAS and for Blocks 10 and 11 to French supermajor TOTAL.

Appraisal drilling work in Block 12 by Noble Energy indicated estimated gross resources in the range of 3.6 Tcf to 6 Tcf (with a mean of approximately 4.5 Tcf).

2014: ENI began its drilling operations at the Onasagoras gas field of block 9 of the Cyprus EEZ. At the end of the year ENI announced non-exploitable discoveries.

2015: ENI commenced a second exploratory drilling in the Amathousa reservoir also in block 9; ENI announced that they had not identified exploitable concentrations of hydrocarbons.

British multinational BG Group acquires a 35% holding in Block 12. Noble Energy remains the license operator, but with its stake now reduced to 35%, while Delek Drilling and Avner Oil Exploration each hold 15% working interest, as previously.

2016: 3rd Oil & Gas Licensing Round Offshore Cyprus (For more information click here)

Royal Dutch Shell completed the acquisition of BG Group.

Israel launches a first official offshore oil & gas licensing round for 24 blocks.(For more information click here)

2017: Lebanon relaunches its first oil & gas exploration licensing round for five offshore blocks. (For more information click here)

The Republic of Cyprus awards exploration licenses to ENI/Total (Block 6), ENI (Block 8) and Exxon Mobil/Qatar Petroleum (Block 10).

ENI acquires a 50% holding in Block 11.

Offshore Exploration Licenses - Republic of Cyprus

* Source: Official Twitter account of Energy Minister Mr. G. Lakkotrypis

The ENI/Total consortium officially announced plans to start drilling in Block 6 by the end of 2017 whereas Exxon Mobil targets to start its drilling operations in Block 10 in the second half of 2018.

Oil & Gas Tax Regime

When a successful applicant is granted a license they are required to enter a Production Sharing Contract (PSC) – prepared and published by the Cypriot Energy Ministry – with the Republic of Cyprus being at all times the legal owner of the hydrocarbons (refer to Article 3(1) of Law 4(I)/2007).

There is no specific regime within the Cypriot income tax law concerning the taxation of contractors and subcontractors.

A tax clause is included in the model PSC which requires all contractors and subcontractors to comply with the applicable Cyprus tax laws and regulations, including any EU tax rules applicable from time to time in the Republic of Cyprus. The corporate tax applicable to the Contractor shall be included in the Republic’s share of Profit Hydrocarbons and shall be paid by the Republic on behalf of the Contractor.

Utilities

In this complex and ever changing sector with players in the market following growth models ranging from fully intergrated (owning production, distribution and even customer base) to others seeking a competitive advantage by concentrating on particular areas of the energy chain, we draw from a pool of local and global specialists to support our clients in a variety of areas.

Mining

Whilst the industry continues to face significant market challenges and constraints, many of the world’s biggest mining companies appreciate what is required for the marathon of mining and have their eyes firmly fixed on the long term rewards. PwC can support you on the way in a variety of areas.

How PwC can help you

In PwC Cyprus we work with a large number of international and local energy companies in all operational areas of the oil and gas industry. We have a local multi-disciplined team of dedicated professionals with secondment experience at PwC Centres of Excellence for oil and gas (Houston and Aberdeen) and we work closely with a number of our 3,000 full time network specialists, who are primarily located in PwC Centres of Excellence for oil and gas in key energy regions of the world.

Drawing from the know-how and expertise of almost 1,000 professionals locally and 160,000 globally we deliver tailored solutions and can support you in the following areas:

- Complying with regulatory and reporting requirements

- Tax structuring and strategies

- Improving performance and operational effectiveness

- Improving and retaining the right people

- Tax Services

- Legal Services

- International Private Clients

Complying with regulatory and reporting requirements

Often dealing with complex regulatory environments, energy companies have over the years worked with us in the following areas:

- Audit services- using a single global methodology, fully compliant with International Auditing Standards, we provide audit comfort through teams possessing appropriate industry expertise and experience

- Reporting and compliance advice- we assist our clients to improve existing capabilities for both internal and regulatory reporting purposes and identify compliance, risk management and governance information needs.

Tax structuring and strategies

Our 150 strong tax team in Cyprus supports a team of industry knowledgeable professionals who, together with over 19,000 dedicated tax specialists globally provide structuring solutions and offer value driven tax services in the following areas:

International Tax Planning

Mergers & Acquisitions

Tax Compliance

Indirect Taxes

International Assignments Services

Improving performance and operational effectiveness

Disciplined cost control for energy companies can be even more critical in times of high price volatility. Commodity price levels may be high today but unpredictability and the cyclical nature of commodity price levels should not allow attention to divert from cost containment.

At PwC we work closely with our clients and have supported a number of companies in the following areas:

Performance improvement

Financial effectiveness

Governance, risk and compliance

Operational effectiveness

IT effectiveness

Improving and retaining the right people

Recruiting and retaining people in this specialized industry, which is facing a decline of student numbers in relevant fields, is as large a challenge as ever. Growing demand for energy which would lead to increased production will only heighten the competition for industry specific and other highly trained professionals to support companies in the field.

At PwC we can support you in the following areas:

- International Assignments

- Reward Planning

- Human Resource Management

Tax Services

In its position as the leading professional services firm in Cyprus, PwC Cyprus can provide assistance and guidance to businesses and individuals in developing tax strategies which both maximise tax benefits and meet all compliance requirements. PwC Cyprus has developed a unique breadth of knowledge and experience through having highly qualified local staff as well as by being connected to about 27.000 tax professionals in PwC offices in 158 countries. As a result, we can assist businesses and individuals in both local and international tax aspects.

Legal Services

International Private Clients

For more than 100 years we have helped energy companies succeed. We look forward to the opportunity to work with you!

- Complying with regulatory and reporting requirements

- Tax structuring and strategies

- Improving performance and operational effectiveness

- Improving and retaining the right people

- Tax Services

- Legal Services

- International Private Clients

Complying with regulatory and reporting requirements

Often dealing with complex regulatory environments, energy companies have over the years worked with us in the following areas:

- Audit services- using a single global methodology, fully compliant with International Auditing Standards, we provide audit comfort through teams possessing appropriate industry expertise and experience

- Reporting and compliance advice- we assist our clients to improve existing capabilities for both internal and regulatory reporting purposes and identify compliance, risk management and governance information needs.

Tax structuring and strategies

Our 150 strong tax team in Cyprus supports a team of industry knowledgeable professionals who, together with over 19,000 dedicated tax specialists globally provide structuring solutions and offer value driven tax services in the following areas:

International Tax Planning

Mergers & Acquisitions

Tax Compliance

Indirect Taxes

International Assignments Services

Improving performance and operational effectiveness

Disciplined cost control for energy companies can be even more critical in times of high price volatility. Commodity price levels may be high today but unpredictability and the cyclical nature of commodity price levels should not allow attention to divert from cost containment.

At PwC we work closely with our clients and have supported a number of companies in the following areas:

Performance improvement

Financial effectiveness

Governance, risk and compliance

Operational effectiveness

IT effectiveness

Improving and retaining the right people

Recruiting and retaining people in this specialized industry, which is facing a decline of student numbers in relevant fields, is as large a challenge as ever. Growing demand for energy which would lead to increased production will only heighten the competition for industry specific and other highly trained professionals to support companies in the field.

At PwC we can support you in the following areas:

- International Assignments

- Reward Planning

- Human Resource Management

Tax Services

In its position as the leading professional services firm in Cyprus, PwC Cyprus can provide assistance and guidance to businesses and individuals in developing tax strategies which both maximise tax benefits and meet all compliance requirements. PwC Cyprus has developed a unique breadth of knowledge and experience through having highly qualified local staff as well as by being connected to about 27.000 tax professionals in PwC offices in 158 countries. As a result, we can assist businesses and individuals in both local and international tax aspects.

Legal Services

International Private Clients

- Cyprus and East Med hydrocarbon potential

- Oil and gas regulatory framework

- Energy regulatory authorities

- Offshore Licensing Rounds and key developments in the Cyprus Oil & Gas Industry

- Oil & Gas Tax Regime

- Utilities

- Mining

Cyprus and East Med hydrocarbon potential

Cyprus has attracted increasing prominence as an international financial centre since its 2004 full accession into the EU. An increasing number of large multinational corporations (MNC's), including leading Oil & Gas Groups, have been structured through the island taking advantage of its OECD fully compliant taxation system, higly educated workforce and open economy.

The island not only lies at the crossroads of important international trade and energy routes but in all probability is surrounded by substantial oil and gas resources, a significant part of which falls within the Cyprus Exclusive Economic Zone (EEZ). Assessments by USGS bring the level of undiscovered oil and gas resources in the Eastern Mediterranean to a total of 3.4 bbl for oil and circa 345 tcf for natural gas.

In terms of major findings to date in the Eastern Mediterranean, Israel has already announced significant findings at Leviathan and Tamar totaling 32tcf of natural gas and still unproven quantities of oil whereas Egypt’s supergiant discovery, Zohr, discovered in August 2015, in the order of 30 tcf has come to confirm and further boost the resource potential in the region. Cyprus to date has announced a 4.5 tcf natural gas discovery (Aphrodite), which is very significant if one takes into account the island’s needs in natural gas which do not exceed 0.035 tcf/year (1bcm/year).

To date, 13 exploration blocks have been deliminated by the Republic of Cyprus at the south of the island following international bilateral agreements with Egypt, Lebanon and Israel on the basis of the UN Convention of the Law of the Sea (UNCLOS) 82. Substantial geological and geophysical data has been gathered the last few years for a number of these blocks and are available in the form of Multi Client Seismic Surveys and Interpretation Reports.

Oil and gas regulatory framework

The Government of Cyprus through the Energy Service of the Ministry of Commerce, Industry and Tourism and other government agencies has put together a number of Laws and Regulations since 2004, governing hydrocarbon exploration and exploitation in Cyprus.

Based on UNCLOS 82 Cyprus has enacted a law in order to define and regulate its EEZ. In 2004 Cyprus passed the Exclusive Economic Zone Law, 2004 (L.64(I) of 2004) – ‘EEZ Law’. Based on the provisions of the ‘EEZ Law’, Cyprus has signed the delimitation agreements with its neighbors (Israel, Lebanon and Egypt) in order to define its EEZ.

The main EU legal instrument by which oil and gas activities in Cyprus are governed by is the Directive 94/22/EC of May 1994 according to which EU member states have sovereign rights over the hydrocarbon resources within their territories.

The above directive is transposed into domestic law by:

The Hydrocarbons (Prospecting, Exploration and Exploitation) Law of No.4(I)/2007 which in 2015 has been amended by Law 186 (I)/2015 (Hydrocarbons Law) .

The Hydrocarbons (Prospecting, Exploration and Exploitation) Regulations of 2007 and 2009 (No.51/2007 and No.113/2009) which in 2014 have been amended by Hydrocarbons (Prospection, Exploration, and Exploitation) Regulations of 2007 to 2014

Offshore Licensing Rounds and key developments in the Cyprus Oil & Gas Industry

- 2006-2008: Seismic surveys within Cyprus’s EEZ.

2007: 1st Oil & Gas Licensing Round Offshore Cyprus (For more information click here)

2008: Exploration License awarded for Block 12 to Noble Energy International Limited.

2011: Noble Energy drilled its first exploratory well and at the end of the year the first natural gas discovery was announced.

2012: 2nd Oil & Gas Licensing Round Offshore Cyprus (For more information click here)

2013: 30% of Noble’s Energy exploration rights in Block 12 are transferred to the Israeli companies Delek Drilling and Avner Oil Exploration.

The Republic of Cyprus awards exploration licenses for Blocks 2,3 and 9 to the consortium ENI-KOGAS and for Blocks 10 and 11 to French supermajor TOTAL.

Appraisal drilling work in Block 12 by Noble Energy indicated estimated gross resources in the range of 3.6 Tcf to 6 Tcf (with a mean of approximately 4.5 Tcf).

2014: ENI began its drilling operations at the Onasagoras gas field of block 9 of the Cyprus EEZ. At the end of the year ENI announced non-exploitable discoveries.

2015: ENI commenced a second exploratory drilling in the Amathousa reservoir also in block 9; ENI announced that they had not identified exploitable concentrations of hydrocarbons.

British multinational BG Group acquires a 35% holding in Block 12. Noble Energy remains the license operator, but with its stake now reduced to 35%, while Delek Drilling and Avner Oil Exploration each hold 15% working interest, as previously.

2016: 3rd Oil & Gas Licensing Round Offshore Cyprus (For more information click here)

Royal Dutch Shell completed the acquisition of BG Group.

Israel launches a first official offshore oil & gas licensing round for 24 blocks.(For more information click here)

2017: Lebanon relaunches its first oil & gas exploration licensing round for five offshore blocks. (For more information click here)

The Republic of Cyprus awards exploration licenses to ENI/Total (Block 6), ENI (Block 8) and Exxon Mobil/Qatar Petroleum (Block 10).

ENI acquires a 50% holding in Block 11.

Offshore Exploration Licenses - Republic of Cyprus

* Source: Official Twitter account of Energy Minister Mr. G. Lakkotrypis

The ENI/Total consortium officially announced plans to start drilling in Block 6 by the end of 2017 whereas Exxon Mobil targets to start its drilling operations in Block 10 in the second half of 2018.

Oil & Gas Tax Regime

When a successful applicant is granted a license they are required to enter a Production Sharing Contract (PSC) – prepared and published by the Cypriot Energy Ministry – with the Republic of Cyprus being at all times the legal owner of the hydrocarbons (refer to Article 3(1) of Law 4(I)/2007).

There is no specific regime within the Cypriot income tax law concerning the taxation of contractors and subcontractors.

A tax clause is included in the model PSC which requires all contractors and subcontractors to comply with the applicable Cyprus tax laws and regulations, including any EU tax rules applicable from time to time in the Republic of Cyprus. The corporate tax applicable to the Contractor shall be included in the Republic’s share of Profit Hydrocarbons and shall be paid by the Republic on behalf of the Contractor.

Utilities

In this complex and ever changing sector with players in the market following growth models ranging from fully intergrated (owning production, distribution and even customer base) to others seeking a competitive advantage by concentrating on particular areas of the energy chain, we draw from a pool of local and global specialists to support our clients in a variety of areas.

Mining

Whilst the industry continues to face significant market challenges and constraints, many of the world’s biggest mining companies appreciate what is required for the marathon of mining and have their eyes firmly fixed on the long term rewards. PwC can support you on the way in a variety of areas.